Part 2: Bloom

Part 2: Bloom#

After nearly 10 months of pivoting around, I’d finally found a good idea. Empowering the next generation of Americans to start building wealth in a safe and educational way was genuinely exciting. I couldn’t stop thinking about it. There were many problems to sort out nonetheless.

Contour had only one employee and that was me. I never had a real job and certainly had not built an investing product before. It wasn’t feasible to build everything by myself and I really needed help. At the same time, the S21 batch was approaching, and we were allowed to participate in demo day. We had a deadline we could put our sights on. This time, I would have to do YC alone without Leo.

I first had to sort out a name for the company. The name Contour sounded rather uninspiring to teenagers. I spent a day or two picking between Bloom and Float. I went with Bloom, which was probably the right choice.

Soon, I brought on a team of contractors. Alexa and Kaiti joined to help out on the marketing front. Finding a designer was particularly difficult. Cindy was the most talented designer that I had found after going through nearly a hundred candidates, so she joined the team as well. On the engineering front, I had Andrew, a friend from college, help me build the product.

We set a goal of trying to get 50,000 waitlist signups for the entire summer. It seemed like an ambitious task especially with a tiny marketing budget. We also set up a Discord server, and it naturally grew to a few thousand members over time. Getting to know some of the earliest users (thank you Jody, Ian, Preston, and so many others) via this channel was probably one of the most fun parts about the early stage. Two of the kids even started dating through the server (although I don’t think they lasted :( ).

The most uncertain part about building the business was figuring out the regulatory end. A founder introduced me to Ethan who was Robinhood’s first lawyer and he was tremendously helpful. I also studied for the Series 66 Exam and pretty much read everything about securities compliance that I possibly could. But there were still things to figure out. First, I didn’t know which regulatory entity to build: a broker dealer or an investment advisor. The former would allow Bloom to monetize in more ways but would be more costly. Second, we could not find a willing executing broker to partner with to support our type of product.

I had a few conversations with Drivewealth regarding offering “custodial accounts,” a type of account which would allow for teenagers to self-direct their own trades. They were stone set on ensuring that all transactions were “double opt-in,” meaning that the parents of the teens would have to manually review and approve every single transaction.

It became evident to me that this approach would not allow teens to have the ownership that is necessary to create meaningful engagement with the product. Imagine having to ask your Dad manually every time you wanted to buy or sell something - it’s not an appealing experience for teens who value independence. I also believed that “safety” could be brought into the product in ways that would align better with both parents and teens through parental controls, which we prioritized and built into the first version of the product. Regardless, working with Drivewealth became infeasible due to this barrier, and I started to worry that building Bloom might not actually be possible.

I previously had another set of conversations with another broker, Alpaca Securities. They were a bit newer and unproven. They could not offer custodial accounts that would allow for teens buy and sell stocks on their own discretion. After talking to five or six people on their team, I found Rich, who had previously been an entrepreneur and understood the struggle of building something from scratch. He was incredibly kind and vouched for Bloom’s needs within the organization.

After a month or so of conversation and sheer persistence, we had somehow convinced Alpaca to partner with us in providing custodial accounts as its first partner. I don’t know what we would have done if they had said no. However, the ability to offer custodial accounts was something that was still put on an indefinite timeline. We didn’t actually know if Alpaca were going to ship it, and there had been a long history of vendors “promising” but not delivering. I took the gamble that they one day would and started integrating with them.

The majority of my time during summer 2021 was spent on the engineering front. Building an entire investment product in a matter of fewer than 3 months to meet the Demo Day deadline was a challenging endeavor. The product had to support and be different for two user types (both parents and teenagers, and they were two separate products), support funding & KYC flows, investing, and more.

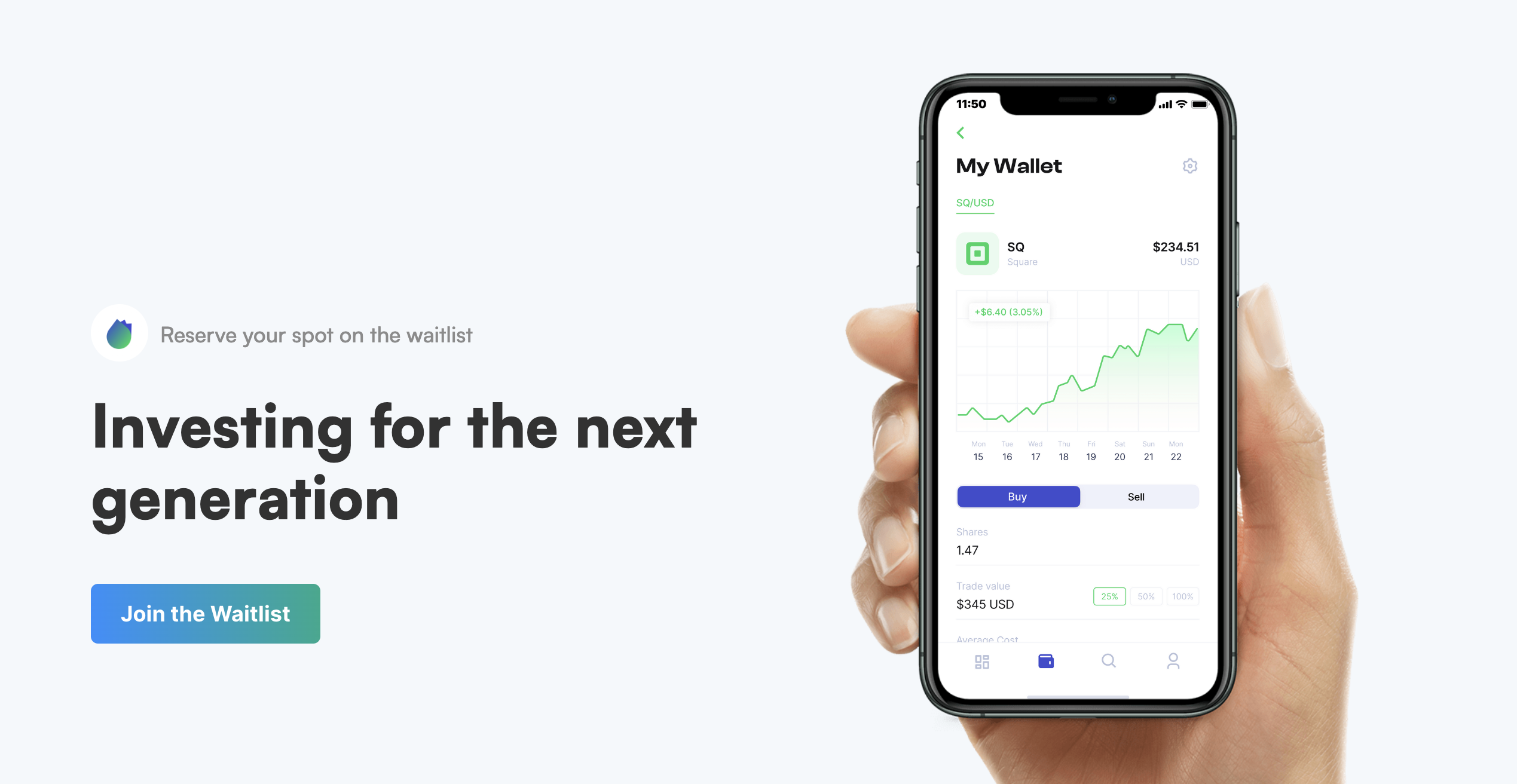

Our first version of the landing page

Our first version of the landing page

The YC S21 batch was probably the time period I had worked the hardest in my life. My routine would be rather simple in those days in SF. I would wake up in the morning, take a shower, and then walk to a Wework. I would return late at night after having coded for 12 or 13 hours straight with meal breaks in between. I would some times take Saturdays off, but for the most part, it was an intense period of constant building.

In retrospect, I think it was good that we pushed through building the product with sheer will. However, I made a set of engineering mistakes upfront that we had to pay the price down the line. As an example, our product for parents had to be a web product. However, since I had already built our design system on React Native for the teen mobile product, we built the parent web product using React Native. An entry level engineer should know how horrifying this decision is (credit to Luca, Sai, and Sid and others for putting up with this).

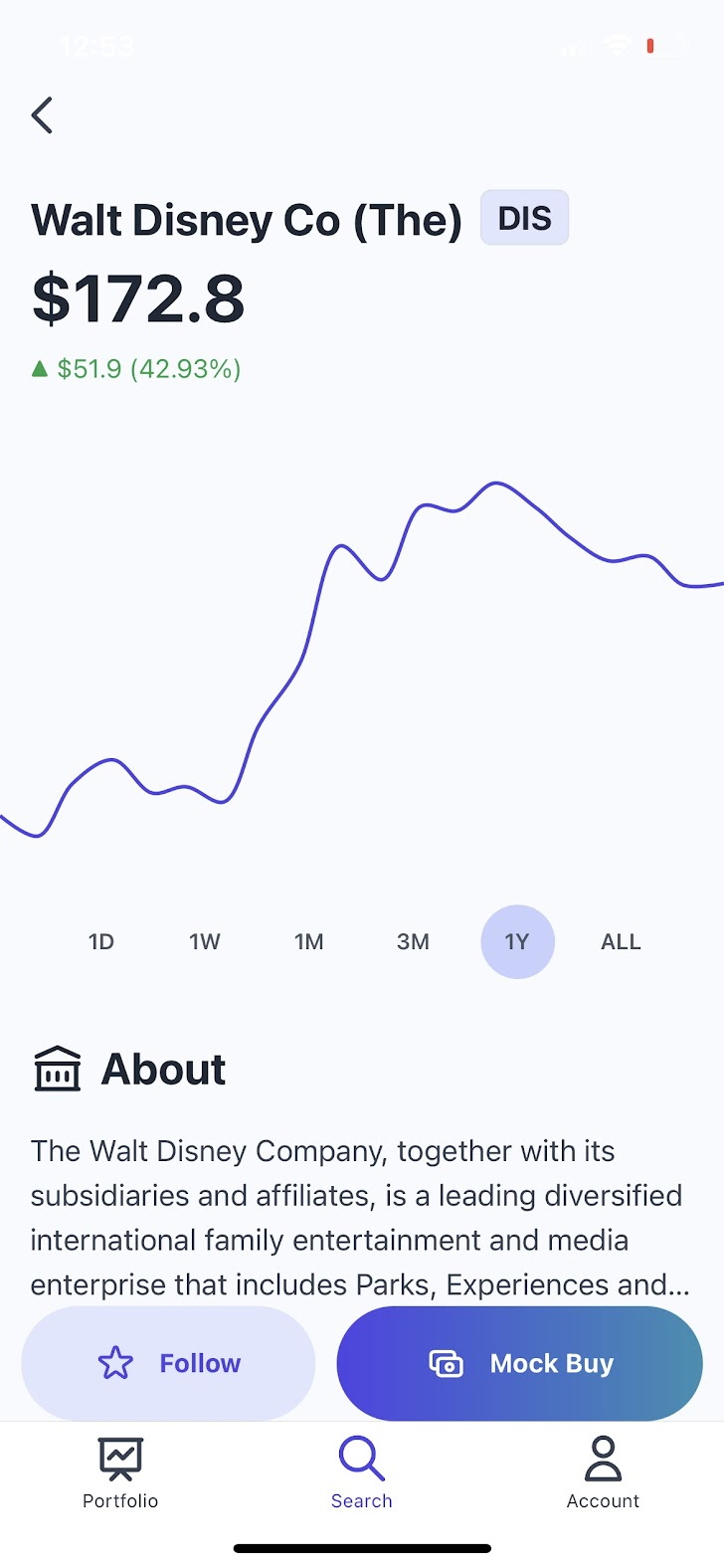

A page in the original app where teens could mock invest to try investing

A page in the original app where teens could mock invest to try investing

I looked for guidance from a more experienced founder who had built something in the investing space. Charlie joined us as an advisor, and I was thrilled. He was someone who I had looked up to ever since I was a student, and to learn from him was a privilege. He saved us from making a lot of really dumb mistakes especially on the compliance/legal front.

At the end of the summer, we had finally built a product that could be used to invest in stocks. It wasn’t anything glamorous but it worked and teens could invest with a limited experience. Alexa and Kaiti had done a remarkable job of hitting over 20K waitlist signups on virtually no spend. It was time to raise money for the company with demo day on the horizon. We created a pitch deck, which Cindy did a remarkable job designing, and I set out to go fundraise.

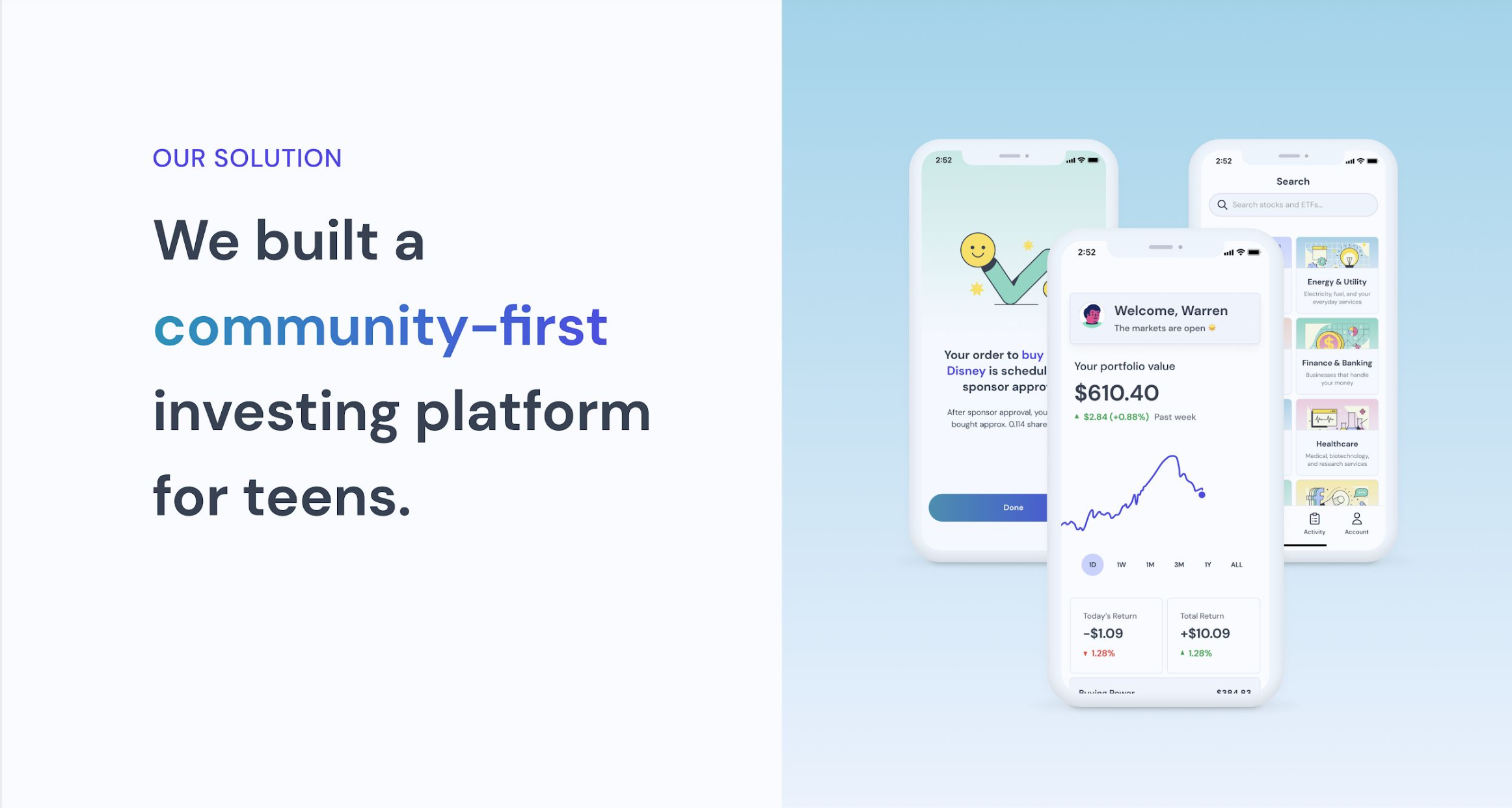

We loved our original community

We loved our original community

Fundraising was initially difficult, and I made a lot of mistakes. The checks slowly started to roll in after I practiced with the help of friends. One issue with fundraising is that companies tend to slow down their growth when in this process as it’s very distracting. In our case, the company just stopped running because I had no co-founders. Worried about having the company be in a halted state for too long, I wrapped up the fundraise in 10 days, raising around $3.4M by the start of September 2021 and still really grateful to the investors who backed us. We fundraised an extra $1M or so during May 2022 when markets were turning.

I think fundraising can be a challenging time for entrepreneurs because they directly hear all the reasons that their business would not work. This rejection can play a role in their internal psychology. For instance, by the end of the fundraise, close to a hundred people told me that Bloom would not work due to competition. “It’s only a matter of time before Robinhood enters the market.”

YC has a maxim of not caring about competition because it doesn’t matter. Yet at the same time, I had two separate YC partners (who I looked up to) imply that future competition (from Robinhood) would be very damaging to this business. The end result was that I ended up being over wary of competition and caring about it a lot. When dozens of people are warning you about one thing, especially people who you respect and have previously built large businesses, it’s hard to completely erase it from your mind. As a consequence, when competition eventually entered the market, I ended up being reactive to its effects, which were close to none.

Everything accelerated after wrapping up the seed round. I brought on two co-founders (Sam and Allan) to the business a few months after, and they accelerated the business. Many things happened since then. We got stuck on launching on the App Store for two weeks, and an investor thankfully helped us. We had to later figure out monetization, which I previously had punted to a later concern because we had set our Series A milestone as a unit of funded accounts. It became quickly evident that any form of transactional revenue would not be meaningful. It felt like constantly having to solve new problems and evolve the business.

The journey was filled with many ups and downs, and it’s impossible to write everything out. Personally, one of hardest moments for me was undergoing an examination by the SEC for nearly a year. It genuinely felt like a form of psychological torture. We worked internally with Jonathan, who was a top compliance expert on the field. Having a Webex call with examiners nearly every week where I was interrogated about the firm for hours on end with never ending material requests became excruciating after several months. It felt like because we looked a little different from traditional solutions and the irresponsibilities other companies in the fintech space, we were being unnecessarily punished.

I remember the each night before the examination calls, there would be a bout of anxiety. Were they going to shut us down? What if they found something that I didn’t know was a problem? There were multiple times when I had felt that the company would be shut down. Even with the examination more or less wrapping up towards the end, the SEC’s methods felt punitive.

After completing a nearly 3 year journey of running Bloom and having left the business, I’ve since had the opportunity to reflect and share the journey in writing. The company has gone through several evolutions but the current team has done a great job of pushing the business forward with now more than 1M+ members and 20M+ lessons taken. I personally have a lot of appreciation for everyone who was involved in the company.

The journey requires resolute persistence against constant obstacles. It is guaranteed to be difficult but also exhilarating. I can’t think of another way in which you would grow and learn so quickly as an individual. I’m also genuinely glad to share that there are more ways for teens today to start building wealth early. Bloom has pushed the frontier here (as competitors copied it), and the financial future for the next generation looks brighter than ever.